Digital advertising is losing billions to inefficiencies and a lack of trust. Blockchain technology offers a solution by creating transparent systems that reduce fraud, cut out unnecessary middlemen, and speed up payment processes. Through joint ventures, advertisers, publishers, and tech providers collaborate to address these challenges by implementing blockchain-based platforms.

Key Takeaways:

- Transparency: Blockchain tracks ad spending and eliminates disputes over billing discrepancies.

- Fraud Reduction: Smart contracts and tools like AdChain verify ad interactions in real time.

- Faster Payments: Automates reconciliation, reducing delays from 24–48 hours to real-time processing.

- Privacy-Focused Platforms: Initiatives like TrustPid ensure data security while complying with privacy laws.

Real-World Examples:

- IBM & Mediaocean: Reduced middleman fees and sped up reconciliation for major advertisers like Unilever.

- Deutsche Telekom’s TrustPid: Enhanced user privacy while enabling targeted advertising.

- NYIAX & Brave Software: Created a blockchain-powered ad marketplace with exceptional user engagement rates.

Blockchain joint ventures are transforming digital advertising by improving efficiency, increasing transparency, and addressing privacy concerns. Starting with pilot projects in areas like OTT video advertising can help businesses test and refine these systems before scaling.

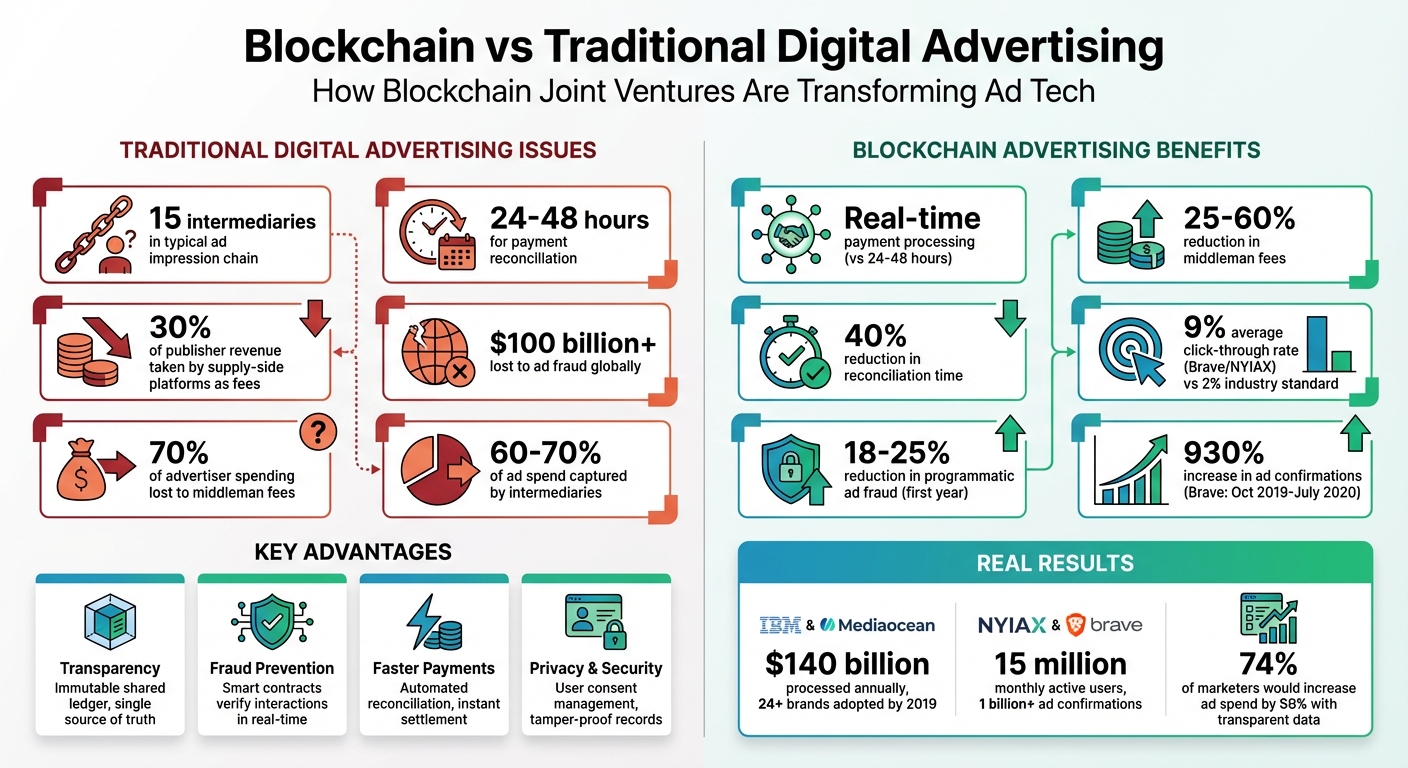

Blockchain vs Traditional Digital Advertising: Key Metrics and Benefits Comparison

Digital Advertising Problems That Blockchain Solves

Blockchain technology is stepping in to address some of the most pressing issues in digital advertising. From inefficiencies that erode trust to budget-draining practices, blockchain-based solutions are tackling three major challenges: lack of transparency, payment delays, and data security vulnerabilities.

Transparency and Fraud Prevention

One of the biggest challenges in traditional advertising is the lack of transparency. Ad impressions often pass through as many as 15 intermediaries, making it nearly impossible to track spending in real time. To make matters worse, supply-side platforms can take up to 30% of a publisher's revenue as fees.

Blockchain steps in with its immutable, shared ledger that keeps a unified record of all ad impressions and spending. This means advertisers, publishers, and intermediaries all have access to the same real-time data, eliminating confusion and guesswork. Ryan Nathanson, Chief Operating Officer at Salon Media, highlights the potential:

"The shared ledger on the blockchain will act as a single source of truth creating indisputable transparency for both the brand itself and the publisher which will aid in greater accuracy during reconciliation as well as make advertiser spend much more efficient".

This transparency also helps weed out unnecessary intermediaries, exposing those who merely extract fees without adding real value. Smart contracts further enhance the system by verifying traffic in real time, blocking bots from generating fake clicks, and ensuring ad budgets are spent on genuine human engagement. Tools like AdChain automatically authenticate ad interactions, reducing the need for manual verification. These advancements not only improve trust but also set the stage for quicker payment processing.

Faster Payment Processing

Another pain point in digital advertising is the delay in payment reconciliation. Traditional systems often take 24 to 48 hours to report data, which leads to discrepancies between what advertisers believe they delivered and what publishers actually received. These mismatches frequently result in billing disputes.

Blockchain changes this by recording ad impression data instantly. With smart contracts enforcing campaign terms, payments are reconciled automatically and in real time. This eliminates delays and reduces discrepancies to nearly zero, thanks to synchronized and transparent records. Advertisers also gain the ability to adjust campaigns on the fly, identifying and addressing issues before budgets are wasted.

Data Privacy and Security

Data security is a growing concern in digital advertising, and blockchain offers a robust solution. Its immutable ledgers ensure that once engagement data is recorded, it cannot be tampered with. This creates a secure environment where records are protected from unauthorized manipulation. By enhancing control over data, blockchain helps advertisers and publishers operate with greater confidence and security.

Case Studies: Blockchain Advertising Joint Ventures

Real-world collaborations demonstrate how blockchain can reshape digital advertising. These partnerships tackled major industry challenges like reconciliation delays and privacy issues, delivering measurable results. Let’s dive into some key examples that highlight the promise of structured blockchain joint ventures.

IBM and Mediaocean Partnership

Back in July 2018, IBM iX and Mediaocean joined forces to form a blockchain consortium that included big names like Unilever, Kellogg, Kimberly-Clark, and Pfizer. The goal? Address the 70% of advertiser spending that was vanishing into middleman fees instead of reaching publishers. Using Hyperledger Fabric, they integrated blockchain into Mediaocean's platform, which processes over $140 billion annually. This created a shared, tamper-proof ledger to track every dollar in the media supply chain.

By early 2019, nearly two dozen brands, agencies, and tech partners had adopted the system. Blockchain technology sped up reconciliation, shifting it from monthly cycles to daily processing. This allowed brands to quickly spot discrepancies and request adjustments or refunds. Rob Master, VP Global Media at Unilever, highlighted the significance:

"What this pilot has shown us is the potential blockchain has to help us drive more quality into the digital ecosystem and get to one source of the truth for our digital investment".

Deutsche Telekom and Partners: Privacy-Focused Ad Platform

While IBM and Mediaocean focused on payment and reconciliation, Deutsche Telekom, Orange, Telefónica, and Vodafone tackled data privacy with their joint venture. They developed TrustPid (now Utiq), a blockchain-based advertising platform designed with privacy in mind. This platform managed user consent and created audit trails for IDs, enabling advertisers to target only those who opted in. The system not only complied with stricter privacy regulations but also allowed users to maintain control over their data while still benefiting from personalized ads.

NYIAX Blockchain Media Exchange

In July 2020, NYIAX and Brave Software launched a blockchain-powered marketplace for trading advertising contracts. Built on Nasdaq technology, the platform enabled advertisers to secure future ad inventory for Brave's 15 million monthly active users, who were part of the Basic Attention Token (BAT) system. The results were impressive: click-through rates averaged 9%, over four times the industry standard of 2%, with some campaigns reaching 15%. Between October 2019 and July 2020, Brave saw a staggering 930% increase in ad confirmations, jumping from 97 million to over 1 billion.

Carolina Abenante, Founder of NYIAX, captured the shift perfectly:

"The Brave NYIAX partnership is going to teach the entire industry the true value of the next generation of consumer advertising - a future in which the consumer dictates the personal value of advertisements in his, her or their world".

This partnership underscores how blockchain can elevate transparency and deliver better ad performance, setting a new standard for the industry.

How to Structure Blockchain Joint Ventures

When setting up a blockchain-based joint venture for advertising, the structure should prioritize business strategy over legal formalities. A well-thought-out design can be the key to success, as it forms the backbone of innovations reshaping digital advertising.

Setting Shared Goals and Objectives

Before drafting agreements, it's crucial for partners to align on clear, measurable goals. As Jeff Cunningham, Partner at Bradley, aptly states:

"The most successful joint ventures start with a clear business rationale, not a contract template".

These goals might include entering new markets, advancing AdTech, or tackling high intermediary fees. Charles Manning, CEO of Kochava, highlighted the potential of blockchain in this context:

"Blockchain presents the opportunity for us to approach the digital advertising landscape and its current challenges from an entirely different perspective".

Establishing rules for participation - such as transparency, data sharing, and exchange terms - is equally important. For instance, when FreeWheel (a Comcast company) launched BlockGraph in February 2018, they created a system that allowed TV stations and advertisers to share data for audience targeting while safeguarding personally identifiable information. This clarity in data-sharing rules became a cornerstone of their success.

Using Smart Contracts and Legal Frameworks

Smart contracts streamline processes by automating transitions from ad delivery to payment based on predefined triggers, cutting reconciliation time by 40%. These contracts encode campaign parameters - like maximum price per impression, duration, and performance metrics - into code. When conditions are met, payments flow automatically through unidirectional payment channels, such as DREW channels, which hold deposits and release funds upon milestone completion.

To ensure accountability, validator stacks requiring mutual sign-off for transactions can be employed. Manning noted this shift:

"We see an opportunity to replace the standard paper-based agreements with a new form of IO, manifested between buyers and sellers through smart contracts".

However, smart contracts are not a replacement for traditional legal frameworks - they complement them. You'll need to decide between a Contractual JV (no separate legal entity, quicker setup) or an Equity-Based JV (a separate legal entity like an LLC). For ventures involving significant financial or operational risks, an equity-based structure is better suited as it protects the parent companies. On the other hand, contractual arrangements are more practical for short-term initiatives like co-marketing campaigns.

Pros and Cons of Blockchain Joint Venture Structures

Blockchain technology offers clear benefits, but it also comes with challenges. Here's a breakdown of the trade-offs:

| Advantages | Disadvantages |

|---|---|

| Transparency: Immutable transaction records | Adoption: Standards take time to develop |

| Efficiency: Cuts middlemen fees (25–60%) | Complexity: Requires shared taxonomies |

| Fraud Prevention: Validates user interactions, eliminating click-bots | Scalability: On-chain Real-Time Bidding (RTB) is difficult |

| Speed: Reduces reconciliation time by 40% | Volatility: Crypto price fluctuations and regulatory hurdles |

The choice between contractual and equity-based structures also has specific implications:

| Feature | Contractual JV | Equity-Based JV (LLC/Corp) |

|---|---|---|

| Entity | No separate legal identity | New separate legal entity created |

| Liability | Partners may share liability | Limited liability; JV assumes responsibility |

| Setup Cost | Lower; faster to establish | Higher; more complex |

| Financing | Harder to attract external funding | Easier to secure third-party investment |

| Best For | Short-term or low-risk projects | Long-term or high-risk ventures |

Starting with pilot projects is a smart way to test blockchain applications. For example, you could implement smart contracts for a single campaign or a specific ad spend area. Begin with contextual targeting to ensure compliance with privacy regulations, and once your system proves stable, expand to more advanced behavioral targeting. This phased approach helps build a strong foundation for scaling blockchain tools in advertising ventures.

Tools and Platforms for Blockchain Advertising

Blockchain-Based Ad Platforms

Blockchain ad platforms are stepping up to address inefficiencies in traditional advertising. Take AdChain, for example. Built on Hyperledger Fabric, it acts as a decentralized verification layer, ensuring transparency and auditability. With consensus nodes validating impressions in real time, disputes over charges become a thing of the past - an essential feature for partnerships where trust is non-negotiable.

Another standout is TAG TrustNet, which uses Fiducia's distributed ledger technology to create a unified record of impression delivery. Between 2019 and 2020, TAG ran a year-long pilot with major brands like Nestlé, McDonald's, Virgin, Unilever, and Johnson & Johnson, along with agencies such as WPP and Publicis. The results? A distributed ledger proved capable of reducing fraud and improving accountability across the advertising supply chain.

The Blockchain-Ads Ecosystem offers a complete package: an ad platform, data marketplace, and attribution tools. Using "Web3cookies" and zero-knowledge proofs, it tracks user behavior anonymously across platforms. Pricing starts at $25 per month for every 1,000 users for Device ID tracking, with analytics and Wallet Address tracking pushing the cost to $35 per month. The average CPM hovers around $3.90, while contextual targeting costs about $3.12.

Meanwhile, Adshares is setting the bar for decentralized advertising in metaverses, games, and AR/VR. By cutting out traditional ad-tech fees, which can swallow up to 70% of ad budgets, Adshares is making advertising in these futuristic spaces more cost-effective. Alongside these platforms, specialized tools are helping refine strategies and performance metrics for blockchain advertising ventures.

The B2B Ecosystem's QuantAIfy AI Tools

For businesses diving into blockchain advertising, the QuantAIfy AI tools provide invaluable support, especially for joint ventures. These tools streamline market entry, pricing, and risk analysis, helping partners align their strategies effectively.

GTM Brain delivers three-month go-to-market plans tailored to blockchain ad platforms, ensuring all partners are on the same page. Price Strategist assists in testing pricing models through competitor analysis and conversion optimization, which is particularly handy when deciding on fee structures to compete with traditional platforms.

To better understand market opportunities, TAM Analyst breaks down the total addressable market, serviceable addressable market, and serviceable obtainable market. This data is crucial for deciding whether to target the $750 billion global advertising industry as a whole or focus on specific regulated sectors like gambling, tobacco, and alcohol, which make up around 8% of the market. Lastly, Risk Analyzer evaluates potential hurdles, such as regulatory challenges or cryptocurrency volatility, offering automated risk scoring based on financial and market data. This helps partners identify and address risks before committing resources.

sbb-itb-01010c0

Best Practices for Implementing Blockchain Ad Joint Ventures

Selecting and Aligning Partners

The success of any blockchain advertising joint venture hinges on a well-defined joint venture agreement. This document should clearly outline objectives, contributions, operations, profit-sharing, and liabilities. Think of it as a roadmap - crucial for navigating technical challenges or market changes that might create tension between partners.

When choosing partners, aim for complementary strengths rather than overlapping expertise. For instance, one partner might excel in distribution and advertiser relationships, while the other brings the technical know-how needed for blockchain implementation. A great example of this synergy is the 2022 Afeela partnership between Sony and Honda - Honda contributed its mobility expertise, while Sony offered advanced technology.

Alignment goes beyond expertise. Leadership styles should mesh well, and it's essential to establish shared definitions early on. This is especially critical for smart contracts, which rely on a common understanding of terms. As Charles Manning, CEO of Kochava, put it:

"We see an opportunity to replace the standard paper-based agreements with a new form of IO, manifested between buyers and sellers through smart contracts".

Your venture should cater to all three key players in the advertising ecosystem: advertisers, publishers, and consumers. Addressing this "chicken-and-egg" problem is vital for overcoming adoption hurdles. Additionally, define an exit strategy upfront. Since joint ventures are often project-specific, detailing how the partnership will conclude - whether through sale, spinoff, or employee ownership - can help avoid costly disputes later.

Once the groundwork is set, the next step is testing the approach with targeted pilot programs.

Pilot Testing and Scaling

Start small with pilots in markets open to innovation. Focus on digital advertising segments where blockchain can clearly add value, such as OTT (over-the-top) video advertising. These markets often have lower query volumes and a smaller number of suppliers, making them a good fit for initial testing. Furthermore, OTT content delivery networks often operate on peer-to-peer models, which naturally align with blockchain technology.

Instead of attempting to overhaul the entire supply chain, target specific pain points. For example, NYIAX partnered with NASDAQ to create a guaranteed media contract exchange, leveraging blockchain to connect financial markets with digital advertising ecosystems. By focusing on a specific use case - like ensuring data immutability - your pilot can validate blockchain's potential in a controlled environment.

During pilot testing, prioritize maintaining data integrity through an immutable and accessible ledger. Test the blockchain's ability to handle anticipated transaction volumes, as newer consensus models are designed to process millions of transactions per second. Document any challenges, especially disagreements among partners regarding data interpretation, and compare the efficiency of smart contract execution to traditional methods. Use these findings to refine your approach before scaling up.

Once the pilot phase confirms the technology's viability, the focus shifts to measuring its impact.

Measuring ROI and Success Metrics

The return on investment (ROI) for blockchain advertising joint ventures often comes from reducing costs tied to fraud and cutting out unnecessary intermediaries. A key metric to track is the reduction in discrepancies between advertiser spending and publisher earnings.

Transparency is another critical measure. Assess how many participants in the supply chain can verify impression delivery in real time. Payment efficiency is also worth monitoring - compare settlement times before and after blockchain implementation. Smart contracts can automate payments once specific conditions are met, potentially shortening the lengthy cycles typical in traditional advertising.

Anna Bager, Executive Vice President of Industry Initiatives at IAB, highlighted blockchain's potential in this space:

"Blockchain seems to be the new 'siren's call' in the business world - but there is no doubt that this technology holds tremendous promise for digital video advertising".

Ultimately, your success metrics should answer one key question: Does integrating blockchain create measurable business value for your joint venture?

Future Trends in Blockchain Advertising Joint Ventures

As blockchain continues to reshape advertising, the focus is shifting from centralized platforms like Google and Facebook to decentralized networks that directly connect advertisers and publishers. With global ad fraud expected to surpass $100 billion in the near future, blockchain-based verification layers are emerging as a powerful solution. These systems can cut programmatic ad fraud by 18–25% within the first year.

Advanced TV and OTT advertising are proving to be fertile ground for blockchain innovation. These channels, with their smaller number of suppliers and lower query volumes compared to display advertising, provide an excellent testing ground for blockchain-powered pilot programs. Many video content delivery networks already operate on peer-to-peer models, making them a natural match for blockchain technology. Experts also highlight how smart contracts could replace traditional paper agreements, simplifying the supply chain and enhancing efficiency.

A growing trend is the rise of hybrid Web2.5 solutions, which blend familiar user interfaces with blockchain's transparency. These systems allow brands to keep traditional user experiences intact while using blockchain for backend verification. For instance, in early 2025, the blockchain gaming platform GALA ran a $20,000 campaign on a decentralized ad network. This campaign successfully acquired 2,500 active users at a cost of $7.50 per user, with smart contracts verifying each interaction to ensure accuracy. Such examples demonstrate how these integrations are paving the way for more advanced applications.

The combination of AI and blockchain is also driving progress, particularly in fraud detection. These systems can permanently document fraudulent impressions, creating a more secure advertising environment. Many joint ventures are now adopting privacy-first targeting models that rely on anonymous wallet interactions rather than invasive personal data tracking. This approach not only addresses privacy concerns but also maintains ad effectiveness - 74% of marketers reported they would increase ad spending by up to 50% if they had access to more transparent data.

Another exciting development is the use of tokenized user rewards, which are transforming how value is exchanged in advertising. In decentralized models, users earn tokens for their attention, bypassing intermediaries that typically capture 60–70% of ad spend. This shift creates a fairer ecosystem and significantly boosts publisher revenue. With venture funding for blockchain startups reaching $3.7 billion, these advancements are quickly moving from experimental stages to mainstream adoption.

Conclusion

Blockchain technology has the potential to redefine digital advertising by addressing some of its most persistent challenges. By leveraging immutable ledgers, it creates a transparent and tamper-proof system that cuts through the opacity enabling fraud and reduces the excessive fees collected by intermediaries. Blockchain-driven collaborations streamline processes, reducing reconciliation errors and intermediary costs, as highlighted by industry initiatives like AdLedger.

The path forward requires collaboration and shared standards. Initiatives such as the 2018 proof-of-concept with IBM, Salon Media, and AdLedger, which used Hyperledger Fabric to track impression-level data, demonstrate how blockchain can reveal inefficiencies in real-time advertising supply chains. These examples show that collective efforts can overcome adoption hurdles and pave the way for broader implementation.

For businesses looking to explore blockchain in advertising, starting with high-impact pilot projects is key. Focusing on areas like OTT video, where fewer suppliers and lower transaction volumes simplify the process, can yield measurable results. Prioritizing fraud prevention and reconciliation can deliver immediate benefits. Smart contracts, for instance, can automate payments and verification, replacing outdated paper-based processes - a solution endorsed by Charles Manning of Kochava.

When paired with AI-driven fraud detection and enhanced data privacy, blockchain moves from being an experimental concept to a practical solution. Partnerships that prioritize transparency, shared standards, and value for all stakeholders - advertisers, publishers, and consumers - will drive meaningful change in the industry.

Ultimately, the success of blockchain in digital advertising hinges on choosing the right partners and focusing on solving real-world problems. The true winners will be those who use blockchain to build fairer ecosystems where ad spending reaches content creators, fraud is curbed through permanent verification, and consumers regain control over their data and attention. This balanced approach underscores blockchain's potential to transform the digital advertising landscape.

FAQs

How does blockchain enhance transparency in digital advertising?

Blockchain brings a new level of transparency to digital advertising by introducing a secure and tamper-resistant ledger that logs every interaction with ads. This ensures that the data remains accurate, traceable, and protected from manipulation.

Through decentralization, blockchain tackles issues like fraud, verifies ad impressions, and builds trust among advertisers, publishers, and consumers. Additionally, it supports real-time tracking of campaigns, allowing businesses to monitor their ad spend and ensure it’s being used efficiently and responsibly.

What advantages do smart contracts offer for advertising partnerships?

Smart contracts bring a lot to the table for advertising partnerships, offering clarity and automating tasks like payments and contract enforcement. They cut down on fraud, remove the need for middlemen, and strengthen confidence between partners, making collaborations smoother and more efficient.

With smart contracts, businesses can simplify their workflows, avoid conflicts, and establish a dependable system for working together in the digital advertising space.

How can businesses use blockchain to enhance their advertising strategies?

To make the most of blockchain in advertising, businesses should first focus on its main advantages: greater transparency, fraud reduction, and accurate data management. Blockchain operates as a secure, shared ledger that records transactions among advertisers, publishers, and consumers, fostering trust and accountability across the board.

From there, companies can dive into practical uses like ad verification, payment tracking, and audience targeting. Pilot programs and case studies are excellent ways to see how blockchain simplifies these processes. For instance, some companies are already leveraging blockchain to track ad campaign spending and ensure greater clarity in their operations.

Achieving success with blockchain also requires a well-thought-out strategy. This means investing in employee training, collaborating with technology partners, and aligning blockchain initiatives with broader marketing objectives. Starting with smaller projects and gradually expanding allows businesses to integrate blockchain effectively while addressing potential challenges along the way.