Machine learning is transforming portfolio risk management by enabling financial institutions to process vast datasets, predict risks, and make informed decisions in real time. Unlike older methods reliant on human judgment and historical data, AI-powered tools analyze market trends, alternative data, and sentiment to detect risks early and optimize portfolios. Key applications include:

- Risk Detection: Real-time monitoring and automated adjustments reduce losses.

- Portfolio Optimization: AI tools streamline asset allocation and scenario testing.

- Fraud Prevention: ML models enhance detection accuracy and compliance.

- Predictive Analytics: Advanced algorithms improve market risk forecasts.

Examples like BlackRock's Aladdin and Barclays' quantum ML integration show how these technologies are reshaping risk strategies. Challenges remain, such as data quality and regulatory compliance, but solutions like explainable AI and robust governance frameworks are addressing these issues. AI adoption is growing, with 88% of firms using it in portfolio management and stress testing models seeing a 26% adoption increase from 2022 to 2024. By balancing automation with human oversight, companies can effectively manage risks while enhancing operational efficiency.

Artificial Intelligence, Portfolio Management & Risk – BlueFire AI

Key Use Cases of Machine Learning in Portfolio Risk Management

Machine learning (ML) is transforming portfolio risk management by introducing practical tools and solutions that deliver tangible outcomes. Here's how ML is reshaping risk management for financial institutions:

Automated Risk Detection and Response

ML models excel at continuously monitoring market conditions, allowing for automated portfolio adjustments and credit risk assessments. For instance, Upstart's platform has increased loan approvals by 28% while handling $5 billion in originations with 67% of processes automated. These systems also enable real-time risk control, where AI-powered tools track market fluctuations and adjust positions to protect against potential losses.

Portfolio Optimization and Scenario Testing

ML algorithms streamline asset allocation by factoring in risk tolerance, market dynamics, and alternative data. Platforms like BlackRock's Aladdin conduct detailed stress tests across various economic scenarios, while tools such as Wealthfront and Marcus Invest customize allocations and predict trends to reduce risk. Additionally, these systems analyze diverse data sources - including alternative and unstructured information - to uncover investment opportunities that might otherwise be overlooked.

Fraud Detection and Compliance Monitoring

Machine learning strengthens fraud prevention by identifying unusual transaction patterns. For example, Alibaba Cloud's system has reduced fraud-related losses by over 50%. Companies like American Express and PayPal leverage advanced ML models to enhance detection accuracy while automating compliance documentation, which significantly cuts down on manual labor . Beyond fraud prevention, ML's ability to process large data sets also improves market risk forecasting.

Predictive Analytics for Market Risk Forecasting

ML models analyze historical data, news, and market sentiment to predict risks more effectively. Barclays, for example, uses quantum computing integrated with ML to improve stock price predictions, enabling trading teams to make strategic, real-time adjustments. By identifying hidden patterns and trends in financial data, ML provides insights that enhance decision-making and risk management strategies.

Case Studies in Machine Learning for Portfolio Risk

Case studies provide a clear picture of how machine learning (ML) can reshape portfolio risk management, offering real-world examples and actionable insights. Below are three examples that highlight the diverse ways ML is being used to tackle risk management challenges.

Case Study 1: AI-Powered Portfolio Management Platform

RAZE Banking, grappling with cyber threats and compliance issues, collaborated with RTS Labs to implement a predictive analytics system. By analyzing historical transaction data, the platform could identify fraudulent activities and enhance compliance processes. The solution emphasized real-time risk tracking and automated responses, leading to impressive results: a 45% drop in fraud cases, a 20% increase in compliance efficiency, and a 30% improvement in overall operational efficiency - all within just one year. This marked a significant shift from reactive risk management to a predictive, proactive approach.

Case Study 2: Anti-Money Laundering System for a Digital Bank

With the rise of digital transactions, Network International turned to FICO's Falcon Fraud Manager to combat money laundering. Using advanced analytics and ML, the system processed transactions in real time, identifying suspicious patterns while ensuring smooth operations across different regions. Navneet Dave, managing director and co-head of processing for the Middle East at Network International, emphasized the importance of staying ahead of threats:

"Fraud solutions must be increasingly sophisticated to protect cardholders."

The result? A system that not only minimized false positives but also scaled efficiently to support a growing client base without disrupting real-time payment processing.

Case Study 3: Predictive Analytics for Market Risk at Barclays

Barclays took a forward-thinking approach by combining quantum computing with ML to refine their market risk forecasting. By leveraging quantum neural networks, they analyzed historical data, real-time news, and even social media sentiment. This integration significantly improved the accuracy of stock price predictions, enabling the bank to transition from reactive risk monitoring to proactive forecasting.

sbb-itb-01010c0

Challenges and Considerations in Implementing Machine Learning

While the benefits of AI in risk management are clear, putting machine learning into practice comes with its fair share of challenges. These hurdles, especially around data quality and regulatory concerns, can make or break the success of a project. Tackling these issues head-on is essential to avoid costly missteps.

Ensuring Data Quality and Model Reliability

One of the biggest roadblocks to effective machine learning is poor data quality. A McKinsey survey found that 44% of organizations feel they can’t adopt AI solutions due to a lack of relevant, accurate, and high-quality data. This problem is compounded by the fact that an estimated 80%-90% of data is unstructured, making it harder to process and use effectively.

The financial toll of bad data is staggering. Gartner reported that in 2017, data quality issues cost businesses around $15 million. Problems like missing values, duplicate entries, and noisy or incorrect data can severely impact the performance of machine learning models. This challenge is particularly acute in the financial sector, where markets shift rapidly, and data accuracy is constantly in flux.

Still, companies that address these data challenges see tangible results. To improve data quality, organizations should:

- Develop clear strategies for collecting relevant and comprehensive data.

- Use automated tools to validate data continuously.

- Regularly perform exploratory data analysis to spot and fix issues early.

These steps can help ensure that machine learning models remain reliable, even in fast-changing environments.

Balancing Automation with Human Oversight

Another major challenge is finding the right balance between automation and human judgment. While machine learning can process vast amounts of data at lightning speed, it lacks the intuition and ethical reasoning that humans bring to the table. Over-automating risk management processes could lead to critical blind spots.

To mitigate this, organizations need a dual approach. Explainable AI (XAI) can help clarify how decisions are made, making it easier for humans to step in when needed. Tiered oversight systems are also effective, allowing routine tasks to run autonomously while flagging complex cases for human review. Additionally, user-friendly dashboards can help staff monitor AI outputs and make informed decisions.

This combination of automation and human oversight ensures that machine learning enhances, rather than replaces, critical decision-making processes.

Regulatory Compliance and Ethical Considerations

As machine learning becomes more integral to risk management, compliance and ethics take center stage. Financial institutions must navigate a complex web of regulations, including Basel III, Dodd-Frank, and MiFID II, while ensuring data privacy and security.

Bias in AI systems is another pressing concern. Historical biases can creep into algorithms, leading to discriminatory outcomes. FINRA has emphasized that while technology can improve trading, compliance, and customer-facing activities, it also introduces new risks.

"A more diverse AI community would be better equipped to anticipate, review and spot bias and engage communities affected." – James Manyika et al

To address these issues, companies should:

- Establish strong data verification processes.

- Conduct regular audits to identify and correct biases.

- Maintain transparent communication with clients about how AI is used in managing their investments.

Clear accountability frameworks are also vital. AI-driven decisions must be explainable to regulators, clients, and stakeholders. Detailed audit trails can help demonstrate compliance with relevant regulations.

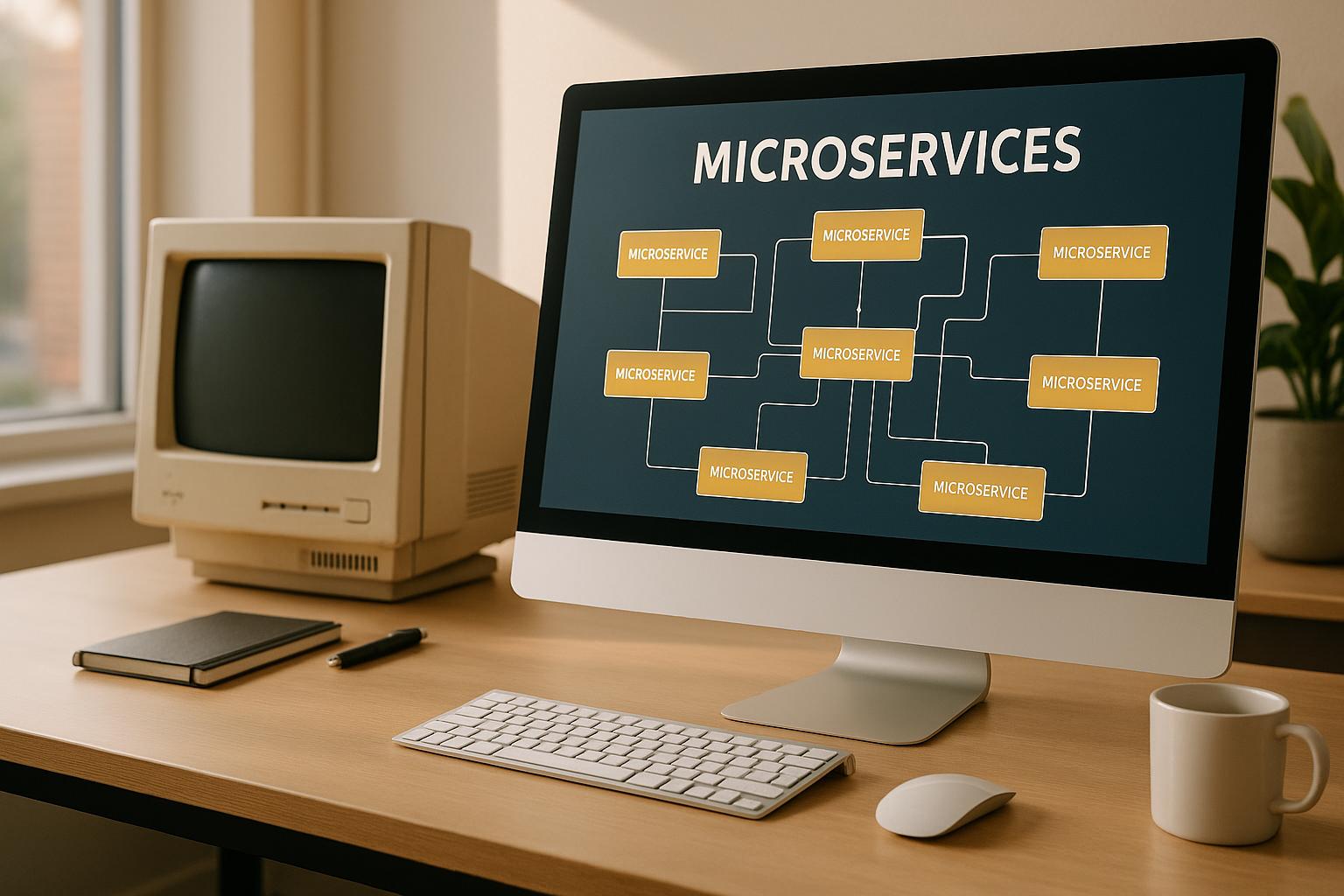

Using The B2B Ecosystem for AI-Driven Risk Management Solutions

Incorporating machine learning into portfolio risk management doesn't have to be a daunting task. The B2B Ecosystem offers a range of tools and services designed to simplify the process and integrate seamlessly into existing risk management strategies. Here's how their specialized solutions can help businesses tackle the challenges of AI-driven risk management.

AI Tools for Portfolio Risk Management

The B2B Ecosystem's QuantAIfy suite is packed with powerful tools like the Risk Analyzer, which provides automated risk scoring by analyzing financial and market data. These tools dig deep into historical market trends, macroeconomic indicators, and critical risk factors - such as credit, market, and liquidity risks - to predict trends, flag potential issues, and fine-tune asset allocation strategies.

For instance, QuantAIfy employs advanced machine learning models like Random Forest, Support Vector Machines, and deep neural networks to:

- Predict asset underperformance

- Classify risk levels

- Assess market sentiment for real-time strategy adjustments

This approach ensures that businesses can make informed decisions based on accurate, data-driven insights.

Consulting and Advisory Services for Implementation

Technology is only part of the equation. The B2B Ecosystem also provides consulting services to simplify the integration of AI into risk management frameworks. These include executive briefings, leadership team discussions, and cross-functional presentations that address the strategic and operational challenges of deploying machine learning solutions.

"Stay ahead of the curve! Align selling to today's B2B buying, reframe conventional wisdom, and motivate your team with Ecosystems' advisory services."

Real-world results speak volumes. For example, Acropolium's tailored AI portfolio platform improved project visibility by 30%, provided 25% better access to essential financial metrics, increased workforce productivity by 17%, and proactively addressed 80% of risks. Additionally, an AI-driven anti-money laundering system enhanced reporting efficiency by 20%, boosted detection accuracy by 45%, and reduced fraud losses by 75%.

Experts recommend that C-suite leaders embrace AI early to take advantage of immediate cost-saving opportunities while refining risk models in real time.

Long-Term Value and Digital Sustainability

The B2B Ecosystem not only focuses on immediate results but also supports long-term value creation while promoting digital sustainability. With 64% of consumers expecting greater environmental accountability, integrating AI into risk management can address both business and sustainability goals.

AI-powered predictive analytics can optimize resource usage and help monitor environmental risks. For example, generative AI has the potential to cut manufacturing and supply chain costs by up to $500 billion. Meanwhile, JPMorgan Chase's Contract Intelligence platform has reportedly saved around 360,000 manual work hours annually.

"Sophisticated simplicity is an approach to analyze complex data and scenarios with a few, simple and holistic indicators providing sufficiently accurate insights to make timely, high-quality decisions in fluid situations."

– Koray Köse, Chief Industry Officer at Everstream Analytics

Conclusion and Key Takeaways

Machine learning is no longer just a buzzword - it’s delivering tangible results in portfolio risk management. Case studies from organizations like Barclays, with their predictive analytics, and digital banks using AI for anti-money laundering, showcase how businesses are redefining risk identification, assessment, and mitigation.

Key Benefits of Machine Learning in Risk Management

Machine learning is transforming risk management by improving both accuracy and efficiency. These AI-driven systems excel at handling repetitive, data-heavy tasks, freeing up human resources for more strategic work. Amanda Cohen, Director of GRC Products at Resolver, highlights this shift:

"Our recent implementation of machine learning within our program enables us to prioritize incidents effectively, allowing us to focus on the most critical matters that demand immediate attention."

Another major advantage is real-time risk monitoring. Machine learning allows organizations to spot potential issues early, shifting the focus from reacting to problems to predicting and preventing them. This proactive approach is a game-changer in risk management.

Final Thoughts on Implementing AI-Driven Strategies

While the benefits of machine learning are clear, successful implementation requires careful planning and human involvement. Technology alone isn’t enough - automation must be balanced with human oversight. It’s worth noting that only 54% of AI projects make it past the pilot phase, highlighting the importance of strategic execution. A Human-in-the-Loop (HITL) approach, which combines AI with human judgment, is essential for maintaining accuracy, safety, and ethical integrity. This is particularly important given recent regulatory penalties for discriminatory AI systems used in credit scoring.

Starting small with pilot projects is a smart way to address challenges like data quality and process refinement before scaling up. With a strategic mindset, machine learning can help businesses move beyond traditional methods, offering real-time risk monitoring and early issue detection to stay ahead of potential threats.

FAQs

How does machine learning improve portfolio risk management compared to traditional methods?

Machine learning is transforming portfolio risk management by using advanced algorithms to analyze massive datasets with precision. These algorithms uncover patterns and trends that traditional methods often overlook, enabling businesses to make smarter decisions and anticipate market changes more effectively.

It also streamlines efficiency by automating intricate tasks like risk modeling and forecasting. This automation not only saves valuable time but also delivers quicker and more reliable evaluations, allowing companies to act swiftly in addressing potential risks. By incorporating AI-driven approaches, businesses can fine-tune their risk management strategies and boost their overall performance.

What challenges do financial institutions face when using machine learning for portfolio risk management, and how can they overcome them?

Financial institutions face a variety of hurdles when incorporating machine learning into portfolio risk management. Common challenges include algorithmic bias, poor data quality, limited availability of reliable training data, and the complexity of machine learning models. These factors can compromise the accuracy and dependability of risk assessments.

To tackle these issues, institutions can take several proactive steps. These include conducting rigorous data validation, applying bias mitigation techniques, and utilizing both supervised and unsupervised learning approaches to strengthen model performance. Building strong frameworks for model validation and monitoring is equally important, as is ensuring transparency and explainability in AI-driven systems. Regular oversight and timely updates to machine learning models are essential for maintaining their effectiveness in addressing financial risks.

How can businesses ensure their machine learning models meet regulatory standards and avoid bias?

To keep machine learning models aligned with regulations and minimize bias, businesses should make regular audits a priority. These audits, paired with specialized tools, can help spot and address discrimination risks while also enhancing the transparency of how models operate.

Equally important is setting up a solid model management framework. This should include detailed documentation and fairness evaluations at every stage of the AI development process. By taking these steps, companies not only stay compliant but also build trust and promote responsible AI practices.